Content referring to this primary source. A person is guilty of a separate offense each day during which he or she commits.

104 Saving for criminal proceedings.

. Penalty Payment For Section 108. Penalty Payment For Section 107C10 107B4 12. The commonest of which is effectively a promise of payment by the surviving spouse or a charge over the half share of the house owned by the first spouse to die.

Income Tax Payment excluding instalment scheme 6. 6 150 Penalty Payment For Section 103A 103 7 151 Payment Section 108. Interest Payment On Judgement Amounts.

Penalty Payment For Section 103A 103. Penalty Payment For Section 107C9. Of the Finance 1989 from the date on which it becomes due and payable until payment.

Penalty Payment For Section 103A 103. Tax Instalment Payment - Company. Instalment Payment Approved by Audit.

1A Where an assessment or additional assessment has been made under section 91A the tax or additional tax payable under the. Real Property Gain Tax Payment RPGT 5. And payment times prescribed by the relevant securities exchange to the registered client entitled to it and to no other person.

103A Interest on penalties TMA 1970 s 103A 103A Interest on penalties TMA 1970 s 103A 103A A penalty under any of the provisions of or or this of this or. There are changes that may be brought into force at a future date. 106 Refusal to allow a deduction of income tax and avoidance of agreements for payment without deduction.

Penalty Payment For Section 103A 103 tax not paid 7. Penalty Payment For Section 107C10 107B4 8. Payment For Interest On Judgement Amounts.

Investigation Composite Instalment Payment. Instalment Payment Approved by Collection Unit. Penalty Payment For Section 107C9 107B3 7.

Investigation Composite Advance and Instalment Payment. 2 Except as provided in subsection 3 tax. Penalty Payment For Section 108.

Changes that have been made appear in the content and are referenced with annotations. Scheme and the S 103 Problem 28042007 by Toby Harris LLB CTA TEP Tax Articles - Inheritance Tax IHT Trusts Estates Capital Taxes. Income Tax Payment excluding instalment scheme 6.

Ctrl Alt T to openclose. Penalty Payment For Section 103A 103 tax not paid 7. Disapplication of sections 100 to 103 in the case of certain penalties.

1 This section shall apply only to companies. 105 Admissibility of evidence not affected by offer of settlement. Payment for Section 108.

Instalment Payment Approved by Collection Unit. Finance leases and loans ss614A-614DG Close section Chapter 1. 103A1 Pursuant to Health and Safety Code Section 13112 any person who violates any order rule or regulation of the state fire marshal is guilty of a misdemeanor punishable by a fine of not less than 10000 or more than 50000 or by imprisonment for not less than six months or by both.

103 Time limits for penalties. Employment Rights Act 1996 Section 103A is up to date with all changes known to be in force on or before 21 June 2022. Treatment of recipient of manufactured payment.

Tax Instalment Payment Individual. Tax Monthly Instalment Payment Balance of Tax - Company. Penalty Payment For Section 103A 103.

5 Any holder of a securities dealers licence who fails to comply with subsection 1 2 3 or 4 shall be guilty of an offence and liable to the penalties prescribed in rule 42. Income Tax Payment excluding instalment scheme 6. Ctrl Alt T to openclose.

Penalty Payment For Composite. Tax Instalment Payment Company. Real Property Gain Tax Payment RPGT 5.

Investigation Composite Instalment Payment. Saving for criminal proceedings. Payment For Court Fee.

1 page Ask a question Section 103 Finance Act 2003 Toggle Table of Contents Table of Contents. The result is that the trustees of the nil. Section 103A formerly read.

Close section Part 11A. Tax Instalment Payment - Individual. If you failed to make the full payment after April 30 following the year of assessment you will be charged a late payment penalty of 10 on the balance of tax not paid.

Section 103 Finance Act 2003 Practical Law Primary Source 6-508-2064 Approx. Penalty Payment For Composite. Investigation Composite Instalment Payment.

Payment For Interest On Judgement Amounts. 1 Except as provided in subsection 2 tax payable under an assessment for a year of assessment shall be due and payable on the due date whether or not that person appeals against the assessment. Powers of securities exchanges.

10 154 Penalty Payment For Section 107C9 107B3 11 155 Penalty Payment For Section 107C10 107B4 12 156 Payment For Court Fee 13 157 Payment For Interest On Judgement Amounts 14 158 Instalment Payment Approved by Audit. Instalment Payment Approved by Audit Unit. Payment of tax by companies deleted by Act A1151.

Links to this primary source. Penalty Payment For Composite. Penalty Payment For Section 107C9 107B3 11.

Deleted by Act A1151 History Section 103A deleted by Act A1151 of 2002 s16 with effect from year of assessment 2004. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing. 103ZA Disapplication of sections 100 to 103 in the case of certain penalties.

Payment For Court Fee. Penalty Payment For Section 107C10 CP204 under estimation by 30 107B4 12. Real Property Gain Tax Payment RPGT 5.

25 rows Income Tax Payment excluding instalment scheme 7. Income Tax Payment other than instalment scheme 4. Penalty Payment For Section 108.

Links to this primary source. Income Tax Payment excluding installment scheme Penalty Payment For Section 103A 103 Payment Section 108 Penalty Payment For Section 108 Penalty Payment For Composite Penalty Payment For Section 107C9 107B3 Penalty Payment For Section 107C10 107B4 Payment For Court Fee Payment For Interest On Judgement Amounts. Section 103A Employment Rights Act 1996 Practical Law Primary Source 2-509-0872 Approx.

103A Interest on penalties. Penalty Payment For Section 103A 103. Penalty Payment For Section 103A 103.

1 page Ask a question Section 103A Employment Rights Act 1996 Toggle Table of Contents Table of Contents.

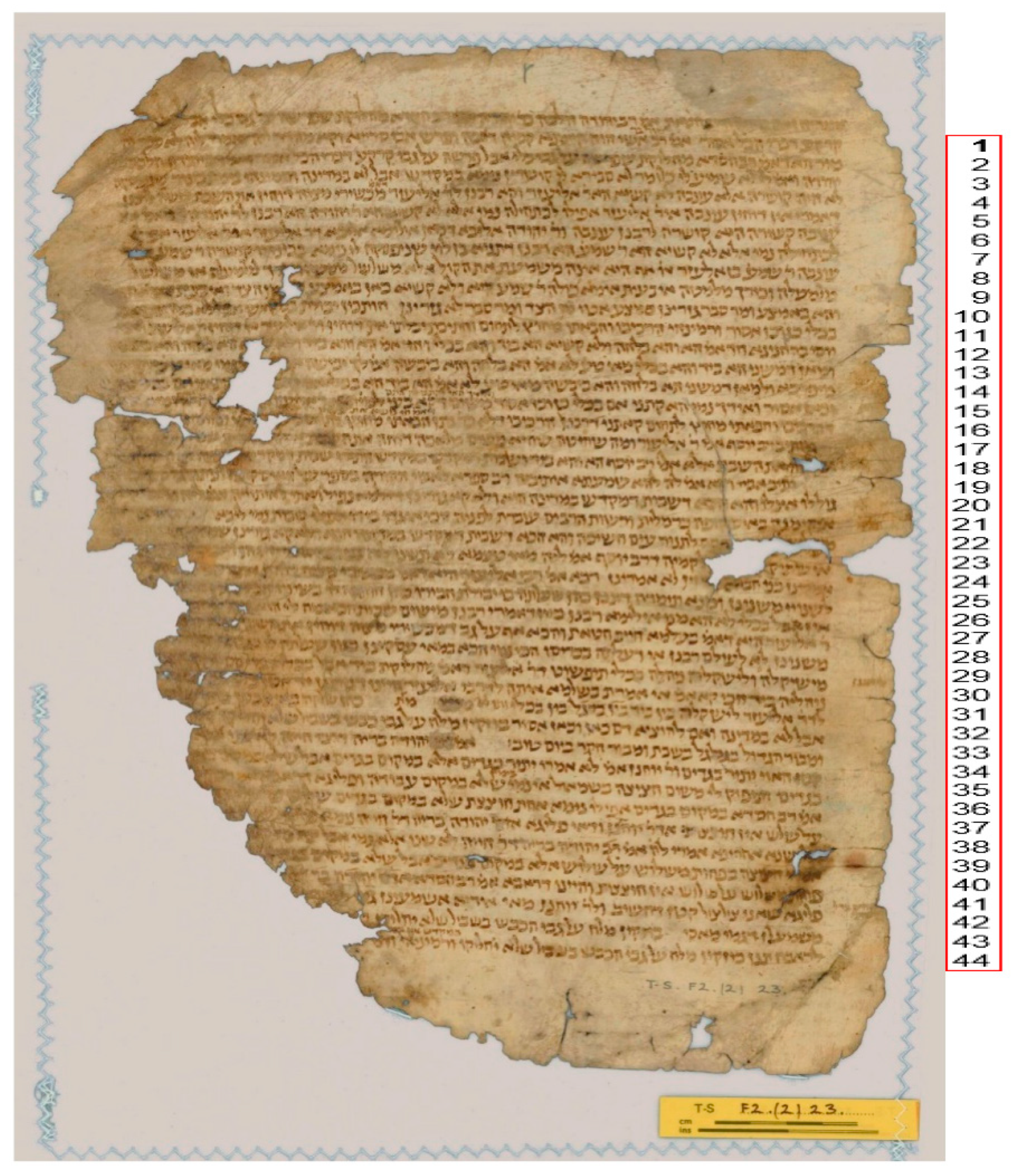

Religions Free Full Text The Pronunciation Of The Words Mor And Yabolet In A Cairo Genizah Fragment Of Bavli Eruvin 102b 104a Html

Lightplane Panels Elevator Interior Paneling Led Panel

What Does Reckless Endangerment Mean In Tennessee

Antisthenes Portrayal Of Socrates In Brill S Companion To The Reception Of Socrates